Higher wages and lower deposits help take sting out of renting, says The DPS in its latest Rent Index

24 January 2020

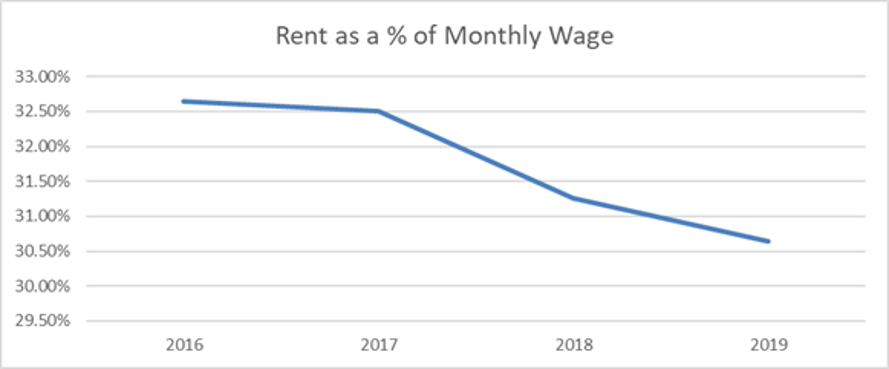

The proportion of income that tenants spent on rent decreased between 2016 and 2019 despite increases in rental levels, according to The Deposit Protection Service (The DPS).

In the latest edition of its Rent Index, the largest protector of deposits in the UK compares rent levels across the country with averages salaries and reveals that the average proportion of wages spent on rent fell from 32.64% in 2016 to 30.64% in 2019.

The DPS said that various factors had helped improve the affordability of renting during the period, including a 2.69% increase in average salary (from £29,559 to £30,353) and a £77 decrease in average tenancy deposits (from £905 to £828) since the introduction of the deposit cap in June last year.

Matt Trevett, Managing Director of The DPS, said: “Although rents have risen over the past decade, other changes since 2016 have helped ensure renting has become on average more affordable.

“Predictions that rents would rise in response to the introduction of the tenant fees ban and deposit cap do not seem to have materialised, with many landlords seemingly declining to increase rents since last summer.”

The DPS Rent Index, which is published quarterly and is based on The DPS database of millions of properties across the UK, also showed that average rents reached a peak of £777 during the third quarter of 2019 (Q3 2019), before decreasing marginally by £4 to £773 during the following quarter.

Paul Fryers, Managing Director at specialist buy-to-let mortgage provider Zephyr Homeloans, which like The DPS forms part of the Computershare Group, said: “Although the longer-term recovery in rental levels is likely owing to broader economic factors, changes to rental figures are also more likely at moments where property changes hands.

“Over the last couple of years, professional landlords have become a larger proportion of the buy-to-let market as more and more smaller or ‘accidental’ landlords sell up, partly as a result of increasing costs.”

Northern Ireland saw biggest increase in average monthly rents (3.01%) from £532 to £548 during Q4 2019, while average monthly rent in Yorkshire and The Humber decreased the most, from £551 to £524 (4.90%).

London continues to be the most expensive rental region in the UK, with average monthly rents standing at £1,345 in Q4 2019 – over two and a half times the amount (£518) paid in the UK’s cheapest region, the North East, during the same period.

Excluding London, average monthly rent during the last quarter of 2019 stood at £672, said the report.

Detached properties saw the largest increase (0.81%) in average monthly rents, from £990 to £998, in Q4.

Monthly rents for terraced houses declined the most during the quarter, falling 0.55%, from £732 to £728.

Average rents increased by 20% between 2010 and 2019, but only by 1% between 2016 and 2019, according to figures from The DPS.

The full Rent Index report is here:

https://depositprotection.com/media/1611/dps_rent_index_q4_2019.pdf

|

|

Rent as % of wages in 2019 |

Average Salary 2019 |

Average Rent 2019 |

|

UK |

30.64% |

£30, 353 |

£769 |

|

London |

40.97% |

£38,992 |

£1,321 |

|

SouthEast |

32.83% |

£32,120 |

£872 |

|

SouthWest |

31.10% |

£28, 654 |

£737 |

|

East |

32.40% |

£30,345 |

£813 |

|

East Midlands |

25.09% |

£28,000 |

£581 |

|

West Midlands |

26.27% |

£28,536 |

£620 |

|

Yorkshire |

23.24% |

£27,835 |

£535 |

|

North West |

25.49% |

£28,137 |

£593 |

|

North East |

23.13% |

£27,187 |

£520 |

|

Scotland |

24.67% |

£30,000 |

£612 |

|

Wales |

25.68% |

£27,500 |

£584 |

|

N. Ireland |

23.45% |

£27,434 |

£532 |