Report on CCJs since 2010: Record highs, lows and what to expect from 2020

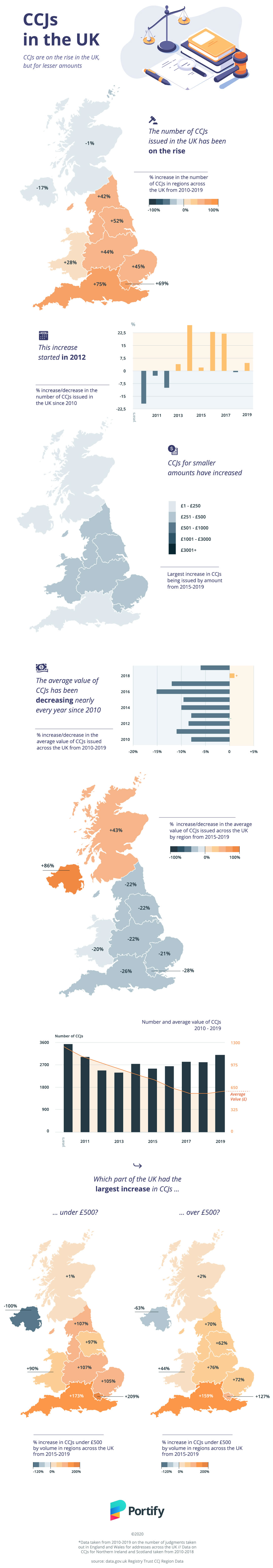

CCJs hit a record high in 2019, but the average value has almost halved since 2010, reaching a record low in 2017. Every region in the UK saw a higher percentage increase in CCJs under £500 than over £500. London and the south had the largest increase in the number of CCJs since 2010. The region of Greater London saw the largest increase in the number of CCJs but also the largest decrease in average value of CCJ of all regions across the UK. Northern Ireland and Scotland were the only regions that saw an increase in the average value of CCJs. The majority of regions in the UK saw the largest increase in CCJs valued at £251-£500.

Our in-house credit expert explained this trend:

“Requesting a CCJ involves both making a court claim, paying a fee and securing a lawyer for the court hearing. This is why in the past businesses only went through the process of taking out CCJs for high amounts. Since the end of the last financial crisis in 2010 the collections industry has boomed, either through consolidation of big players or through PPI processors moving into the space. This means that due to economies of scale at the processing stage, the cost of getting a CCJ became competitive and cheaper for businesses via these third parties. It has also meant that companies were able to introduce CCJs as a debt recovery tool on lower amounts or as a new strategy altogether”.

The number of people in their 20s with court orders for unpaid debt has been on the rise over the past year, according to the BBC Radio 4 programme Money Box. A CCJ can remain on your record for up to 6 years from the date of issue unless you pay the full amount owed within one month. A CCJ will impact your credit score and can affect your ability to obtain credit, employment and a place to live while it is actively on your report.

Registry Trust data shows over 120,000 County Court Judgments (CCJ) were given in 2019—a record high. Financial experts attribute the rise in CCJs to increased use of payday loans, zero-hour contracts, unstable loans, increasing rent prices and defaults due to unpaid mobile contracts. Most people don’t realise that mobile contracts are a debt that they can default on. In fact, mobile providers have increased the rate at which they sell this type of debt to credit collectors.

As for what to expect in 2020 our expert said: “Given the economic uncertainty caused by COVID in 2020, and the reports showing an increase in the number of firms and individuals in financial distress across the UK we can expect to see a rise in the number of CCJs in the months after the economy starts to recover”.

Published: 20 October 2020