The Ultimate Credit Builders for 2020

Building credit can feel like a catch-22. You are told you need to apply for a credit card or take out a loan so you can prove you’re capable of continually paying it off on-time. However, you might not be able to get a loan or will only be able to get one with sky-high interest rates if you have a bad credit score. If you have less than stellar credit and are at your wits end, don’t despair. This article will take you through credit building apps, cards, and credit monitoring services that you can use to help build your credit.

There are different ways to build your credit. You can get apps that will guide you through the process of building credit or a credit builder credit card. In the UK, you can also register to vote to give your credit score a little boost. In order to build credit you can’t just use an app or a card though. You must remain financially responsible. This includes paying bills on time, avoiding unplanned overdrafts, and spending responsibly. Make sure you are monitoring your credit score as you work to build it.

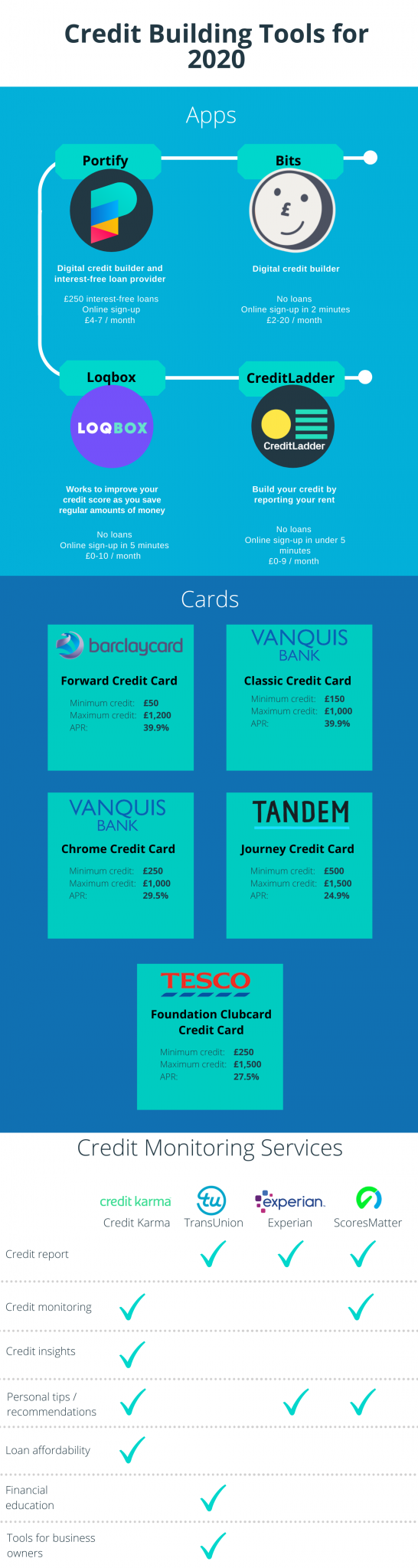

4 Credit Builder Apps for 2020

- Portify: Portify has partnered with Experian to provide credit score building and interest-free loans. The app allows for balance prediction and income management to ensure you never miss another bill payment. Each monthly subscription payment and loan repayment on the app is reported to Experian and builds positive credit history.

Cost: £4 per month for a standard account; the Portify Plus account costs £7 per month. - Bits: Bits is a digital credit building service that also boosts your Experian credit score. They also build your credit by reporting monthly payments to Experian. Keep in mind that Bits warns it is not a service for everyone — they do not recommend you use their app if you are heavily indebted, behind on bills, have declared bankruptcy recently, or if you are generally struggling financially.

Cost: Fees range between £2-20 per month, depending on your account. - LOQBOX: LOQBOX is a tool that builds your credit score over the course of a year so you can access more lenders and better rates. LOQBOX reports to all three credit agencies. To use the service, you tell LOQBOX how much you think you can save in a year. This amount is locked away in a 0% APR loan which you pay off each month. At the end of the year, they return your money to you in full. While this process can help your credit score, they advise quitting immediately if you miss a payment, as missing a payment will negatively affect your score.

Cost: They have 3 packages, each with different benefits, which range from free to £10 per month. If you want to access your money, but don’t open an account with them, they charge an additional £30. - CreditLadder: CreditLadder is an app that ensures your rent payment each month builds your Experian credit history. Where mortgage payments have helped homeowners improve their credit, renters have largely been left behind. CreditLadder also reports your rental history to one of the largest UK financial institutions, Nationwide. If you are a first-time homebuyer, using this app gives you access to better mortgage rates with Nationwide.

Cost: Free to tenants, but they offer a paid version (£9/month) where you can save more money and access free mobile phone insurance.

5 Free Credit Score Apps to Check Your Credit Score

- Credit Karma: Credit Karma’s app allows you to compare offers for credit cards, auto loans, home loans, and more without hurting your scores. They offer credit monitoring, provide insights on what affects you most, and make personalized recommendations.

- Experian: They are one of the most trusted scoring systems in the UK and offer free credit reports as well as personalized tips on how to get your finances in tip-top shape.

- ScoresMatter: ScoresMatter provides free credit reports and credit monitoring, a loan affordability assessment to see what you might be able to afford, as well as a dark web scan for additional online protection against identity theft.

- TransUnion: In addition to credit reports, they offer educational materials to help you understand your report, how to improve your score, and, if you’re a business owner, how to prepare to apply for business lending.

Find out more here - https://blog.portify.co/the-ultimate-credit-builders-for-2020/

Published: 22 October 2020